Student Reimbursement Process & Timeline

Overview

To be reimbursed for an eligible PRE-APPROVED expense (ex: pre-approved Dean’s Council funding, Wellness Grants, i2i grants, etc.), submit the Student Reimbursement Request google form. Submit this form as soon as possible after receiving receipt(s) and attendance information - no later than 14 days after the purchase / event.

- Clerkship Travel reimbursement questions: Visit the Off-Site Clerkship Travel and Early Morning Transportation - Uber/Lyft webpages.

- Conference Funding: Apply via the Student Conference Funding Support Application form.

Reimbursement Process

- Form Submission:

Student Reimbursement Requests are processed by the Pritzker Student Programs Admin Team (Kate, Candi, Alyssa) and submitted to the University’s Payroll Office. - Payment Timeline:

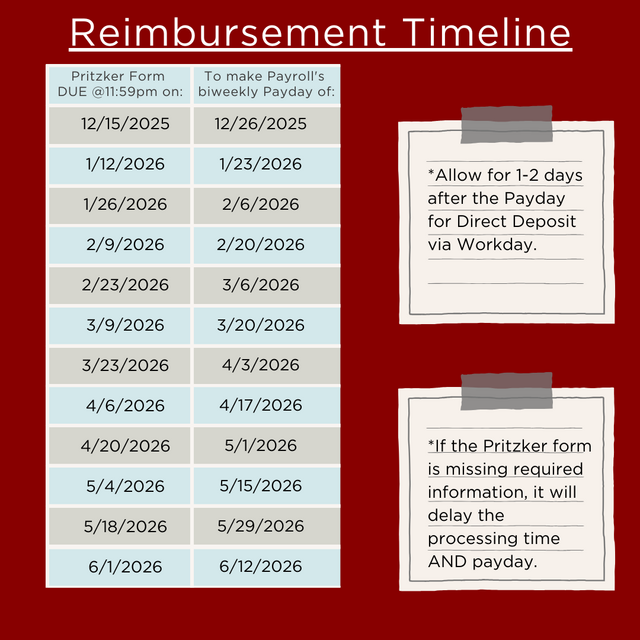

Payroll operates on a bi-weekly schedule; paydays are every other Friday. To meet the payroll processing deadline for each biweekly payday, the Student Reimbursement Request Google Form is due by the Monday of the week prior to payday. - Direct Deposit:

Check your Workday account to confirm direct deposit enrollment. If not enrolled, physical checks are mailed and may take 2–4 weeks after payday to arrive.

Tax Exemption Reminder

- Pritzker cannot reimburse tax paid. If you end up paying tax, it will not be reimbursed. Only pre-tax amount and eligible tip are reimbursed

- It is your responsibility to check and follow the vendor’s process for tax exemption before purchase (Tax Exemption letter found here).

Questions? Contact pritzkerstudentaffairs@bsd.uchicago.edu or visit BSLC 104R.